We live in the digital age, the age of networked computers and commoditized information. For better or for worse, the global computer networks are expanding, and that expansion is accelerating, particularly with the AI boom of recent years and the growth of the Internet of Things.

Confident Investing Starts Here:

This growth in digital networking has brought with it an increased demand for cybersecurity services, a need that has been highlighted by recent geopolitical developments. Iran, for example, has a long history of employing, or attempting to employ, unconventional tactics against its adversaries, including cyberattacks. And that last has put global cybersecurity companies into investors’ sights.

Given this environment, it’s reasonable to expect that governments and critical organizations – financial institutions, medical facilities, utilities – will ramp up their cybersecurity defenses. Investors, in turn, may see major cybersecurity firms landing new contracts or onboarding new customers in the coming months.

This rising demand is set against the backdrop of an already enormous cybersecurity market. Valued at $172.2 billion in 2023, the market is projected to balloon to $562.7 billion by 2032, according to Fortune Business Insights, reflecting a CAGR of 14.3%.

Bank of America has taken note, and is looking at CrowdStrike (NASDAQ:CRWD) and Check Point (NASDAQ:CHKP), two major names in the cybersecurity industry. The bank is weighing these leaders to determine which offers the stronger investment opportunity. Let’s take a closer look at both, and see which one BofA prefers.

CrowdStrike

The first stock we’re looking at here, CrowdStrike, was founded in 2011 and today has grown into a $124 billion leader in the cybersecurity industry. CrowdStrike’s specialties are identity threat detection, endpoint security, and ransomware protection.

The company’s Falcon platform, its flagship product, takes a proactive approach to digital security, using active threat detection to prevent breaches. Falcon is a cloud-native platform that supports multi-tenant intelligent security solutions in the cloud or virtualized environments. Even better, the system provides protection at all endpoints, including desktops and laptops, as well as IoT devices, servers, and virtual machines. CrowdStrike operates on the popular SaaS subscription model and offers multiple cloud modules through the Falcon platform.

Building on these capabilities, CrowdStrike is actively moving to position itself as a security provider with and for AI, addressing a critical gap as most companies with active AI programs are not yet tackling the unique security risks associated with AI. CrowdStrike aims to fill this gap by safeguarding sensitive data while maintaining system integrity.

Altogether, these strengths support CrowdStrike’s ambition to deliver a security platform that can meet the needs of any customer, at any time. The company achieves this through a modular approach, allowing subscribers to select packages and features that best fit their needs, and combining them with flexible pricing plans to suit a range of budgets. The key, for CrowdStrike, is recognizing that one size does not fit all.

That strategy appears to be paying off. Earlier this month, CrowdStrike reported results from its fiscal 1Q26, posting quarterly revenues of $1.1 billion, up 19% year-over-year. At the bottom line, CrowdStrike delivered a non-GAAP EPS of 73 cents, 7 cents per share ahead of expectations. Looking ahead, the company exited fiscal Q1 with $4.4 billion in annual recurring revenue (ARR), adding a net of $194 million in new ARR during the reporting period. Not surprisingly, shares of CRWD are up 46% so far in 2025.

However, Wall Street’s enthusiasm is not without caution. Bank of America’s 5-star analyst Tal Liani, who covers this stock, sees CrowdStrike in a solid position but questions whether its current valuation offers enough upside.

“We favor CrowdStrike’s fundamentals and growth prospects, but believe the valuation leaves only limited upside from the current level of 20x CY26E EV/Sales. Growth has decelerated to below 20% in 1H26, and while we expect acceleration to about 22% in 2H on the back of CCP related renewals, we believe growth will decelerate in the next few years, hence our growing focus on valuation,” Liani noted.

Reflecting this, Liani rates CRWD shares as Neutral (i.e., Hold), with a $470 price target that implies a ~6% downside over the next year. (To view Liani’s track record, click here)

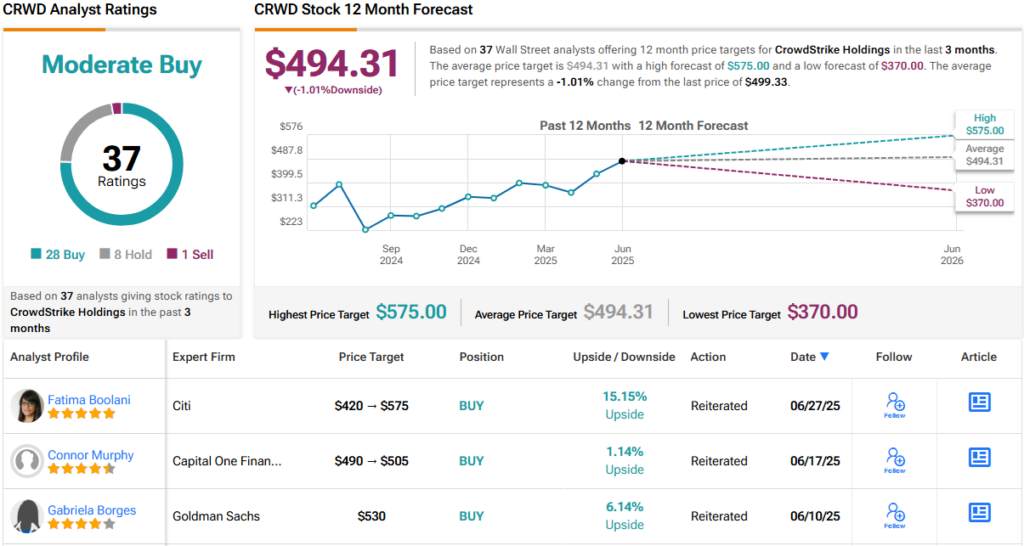

Overall, among 37 recent analyst reviews, there are 28 Buys, 8 Holds, and a single Sell, giving CrowdStrike a Moderate Buy consensus rating. However, with a current price of $499.33 and a $494.31 average price target, most analysts expect the stock to trade roughly sideways over the next 12 months. (See CRWD stock forecast)

Check Point

Check Point, the second stock we’ll look at here, has been in the software and cybersecurity business since 1993, making the company an old name in a new field. The firm’s stated mission is simple but ambitious: “to secure the digital world for everyone, everywhere.” To accomplish this, Check Point has put together its Infinity Platform to provide cutting-edge solutions for cyber defense against even the most sophisticated attacks. The company’s product portfolio includes Quantum, which secures networks; Harmony, for workforce security; and the aptly named CloudGuard.

These solutions are supported by Check Point’s highly skilled workforce of more than 7,000 employees, including over 3,500 dedicated security experts, who protect more than 100,000 enterprise clients worldwide. This deep bench of expertise underpins the company’s guiding philosophy that “prevention is the best cure,” reflecting Check Point’s focus on proactive, rather than reactive, cybersecurity.

This prevention-first strategy has not only shaped its technology but has also translated into strong business results. In its last reported quarter, 1Q25, top-line revenues came to $638 million, up 7% year-over-year, while non-GAAP EPS rose 9% to $2.21, beating forecasts by 2 cents per share.

Several additional metrics also bode well for Check Point. Cash flow from operations increased 17% year-over-year to $421 million, calculated billings climbed 7% to $553 million, and its work backlog, represented by remaining performance obligations, expanded 11% to $2.4 billion.

Given these results, it’s no surprise that Bank of America analyst Tal Liani remains upbeat on Check Point, describing it as a cybersecurity name with a solid foundation to build on.

“We believe that further stock appreciation depends on the company’s ability to sustainably accelerate growth and flag recent changes that support our growth acceleration expectations, such as new sales leadership, a new CTO, effort of the CEO to meet key customers, etc. These processes should translate to growth acceleration but should take time to bear fruit. We also flag management’s measured approach designed to maintain the current margin level,” Liani opined.

In line with this assessment, Liani rates CHKP as a Buy, complementing that with a $260 price target, which suggests a one-year upside potential of 20%.

All in all, Check Point has 25 recent analyst reviews on record, and the almost even split between Buy and Hold gives the stock its Moderate Buy consensus rating. The shares have a selling price of $216.45 and an average target price of $239.23, together implying a modest gain of 10.5% on the one-year horizon. (See CHKP stock forecast)

After setting out the facts, it’s clear that Bank of America has chosen Check Point as the superior cybersecurity stock to buy in today’s unsettled world.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

1