Industrial Cyber Security Market Summary

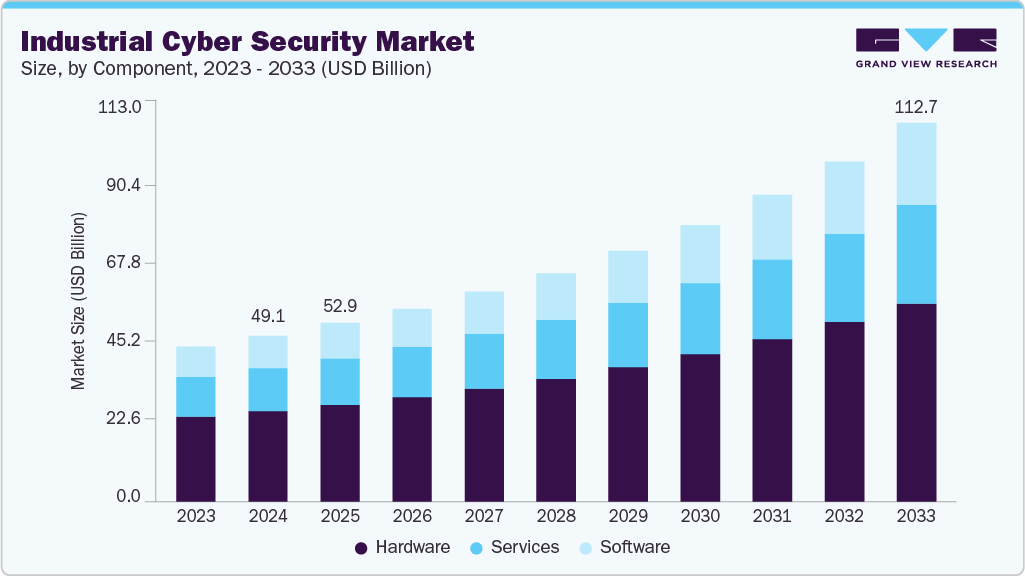

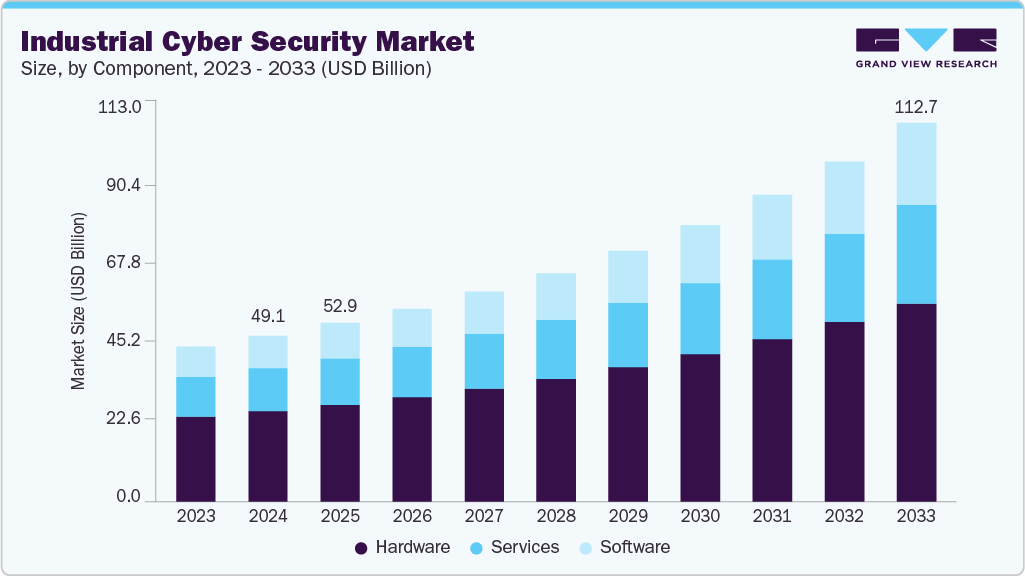

The global industrial cyber security market size was estimated at USD 49.13 billion in 2024 and is projected to reach USD 112.66 billion by 2033, growing at a CAGR of 9.9% from 2025 to 2033. The growing convergence of operational technology (OT) and information technology (IT) systems across critical infrastructure and manufacturing environments is driving the growth of the industrial cyber security industry.

Key Market Trends & Insights

- North America held a 36.5% revenue share of the global industrial cyber security market in 2024.

- In the U.S., the increasing frequency and sophistication of cyberattacks targeting industrial operations is accelerating the demand for industrial cyber security systems.

- By component, the hardware segment held the largest revenue share of 54.9% in 2024.

- By solution type, the SCADA segment held the largest revenue share in 2024.

- By security type, the infrastructure protection segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 49.13 Billion

- 2033 Projected Market Size: USD 112.66 Billion

- CAGR (2025-2033): 9.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

The rising adoption of Industrial Internet of Things (IIoT) devices and cloud-based platforms is driving the industrial cyber security market growth. These technologies enable real-time monitoring and predictive maintenance, but they also introduce complex cybersecurity challenges due to the sheer volume of devices and the necessity for secure data transmission. Industrial organizations are responding by integrating cybersecurity at both the network and device levels, driving demand for solutions that offer device authentication, encrypted communication, and anomaly detection powered by AI and machine learning. Moreover, the growing reliance on third-party vendors and remote access for managing OT infrastructure makes it essential to deploy identity and access management (IAM) systems, secure remote connectivity, and zero-trust architectures, further boosting the market.

The growth of digital twins, predictive maintenance, and advanced analytics in industrial settings is further intensifying the need for sophisticated cybersecurity frameworks. These technologies depend on the seamless flow of real-time data across machines, sensors, cloud platforms, and analytics engines. Any interruption, manipulation, or unauthorized access to this data degrades operational efficiency and poses significant risks to safety and asset integrity. Consequently, companies are deploying end-to-end encryption, secure APIs, and network segmentation techniques to ensure data authenticity and integrity in highly digitized industrial workflows. This shift is especially evident in high-stakes sectors such as aerospace, automotive manufacturing, and energy production, where even brief system failures can result in millions of dollars in losses or regulatory violations.

The trend toward decentralized industrial operations enabled by mobile, edge computing, and 5G connectivity is also transforming cybersecurity needs. With more devices and control systems being deployed at the edge of networks rather than centralized locations, the potential entry points for cyber threats have multiplied. Traditional perimeter-based security is no longer sufficient, and as a result, zero-trust architectures and secure edge computing frameworks are being adopted to protect dispersed assets. These architectures assume every user, device, or system is untrusted by default and must continuously validate identity and security posture before accessing industrial networks. This model is proving vital for companies managing remote facilities, such as wind farms, offshore rigs, or mining sites, where physical oversight is limited.

Furthermore, the expansion of smart factories and Industry 4.0 initiatives across various sectors is contributing to the growth of the industrial cybersecurity industry. Smart factories rely on interconnected sensors, programmable logic controllers (PLCs), robotics, and AI-driven decision-making systems to enable predictive maintenance, automated workflows, and quality assurance. However, these highly automated environments are also attractive targets for cyber attackers due to their complexity and reliance on real-time data. A breach in these ecosystems can halt operations and lead to significant productivity losses. To address these vulnerabilities, manufacturers are embedding cybersecurity into the design phase of smart factory infrastructure, deploying anomaly detection, identity management solutions, and real-time monitoring systems that can rapidly isolate threats without shutting down production.

Component Insights

The hardware segment dominated the industrial cyber security market with a revenue share of 54.9% in 2024. The rising integration of edge computing and localized data processing in industrial setups is further boosting the demand for hardware-based security. Edge devices, which often operate in remote or unmanned locations, require self-contained security capabilities to protect against physical and cyber intrusions. Ruggedized security appliances, which combine computing power with real-time encryption, firewall, and threat detection features, are being deployed at these edge nodes to reduce latency and ensure secure communication with centralized systems. This growing infrastructure creates a new demand for robust, low-power, and secure hardware components tailored for harsh industrial environments.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. The rising number and sophistication of cyberattacks targeting industrial infrastructure also amplify the demand for services. Attacks like ransomware, phishing, and supply chain breaches can cripple production, endanger personnel, and disrupt national critical infrastructure. In response, companies are investing in services such as continuous monitoring, threat intelligence, and forensic analysis to enhance situational awareness and strengthen response capabilities. Managed Detection and Response (MDR) and Security Operations Center (SOC)-as-a-service offerings are gaining traction among industrial players who need around-the-clock security coverage but lack the internal resources to operate their SOCs.

Solution Type Insights

The SCADA segment dominated the industrial cyber security market in 2024. The rise of edge computing and distributed energy resources also contributes to the need for robust SCADA security. In modern industrial setups, control and data processing are no longer centralized but occur across distributed edge nodes. SCADA systems must coordinate inputs from multiple, often remote, sources, increasing their attack surface and necessitating endpoint security, network segmentation, and decentralized threat response mechanisms. Security frameworks must evolve to accommodate the decentralized and dynamic nature of these environments, ensuring that each node can detect, respond to, and recover from threats independently without compromising system-wide functionality.

The DDoS segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing use of IoT and IIoT (Industrial Internet of Things) devices in industrial settings has also made DDoS mitigation more vital. These devices, if not properly secured, can be hijacked to form botnets capable of launching massive DDoS attacks. High-profile botnets like Mirai and its variants have demonstrated how IoT vulnerabilities can be exploited to target enterprises and entire segments of critical infrastructure. In response, manufacturers and industrial operators are integrating DDoS prevention solutions into their device-level and network-level security architectures, ensuring that edge devices are protected from being targeted and from being weaponized in larger attack campaigns.

Security Type Insights

The infrastructure protection segment dominated the industrial cyber security industry with a market share of over 28.0% in 2024. The increasing convergence of cloud computing, edge processing, and big data analytics in industrial operations further necessitates comprehensive infrastructure protection. While these technologies enable smarter and more decentralized operations, they also create new vulnerabilities due to distributed attack vectors. Protecting data as it moves between cloud platforms, edge devices, and on-premise systems becomes critical. Infrastructure protection solutions are thus expanding to include secure gateways, encrypted communication protocols, and identity-based access controls that ensure only authorized users and devices can interact with industrial networks. As the industrial landscape continues to evolve, the infrastructure protection segment will remain at the forefront of cybersecurity strategy, offering the resilience and assurance needed to thrive in an increasingly digital and interconnected world.

The cloud security segment is projected to be the fastest-growing segment from 2025 to 2033. Vendor ecosystems also play a role in accelerating cloud adoption and, by extension, cloud security needs. Major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are increasingly offering industry-specific platforms tailored to manufacturing, energy, and utilities. These platforms include tools for data ingestion, machine learning, and digital twin modeling. While they bring powerful capabilities, their use also introduces the challenge of multi-tenant environments, shared responsibility models, and potential misconfigurations, all of which require specialized security controls. Therefore, organizations must implement continuous configuration assessments, security posture management tools, and role-based access controls to ensure that cloud services are used securely and responsibly within industrial workflows.

Deployment Insights

The cloud segment dominated the industrial cyber security market in 2024. The expansion of remote work and global industrial operations is driving the segment growth. Engineers, operators, and decision-makers often need to access industrial systems and data from various locations, including remote sites and field operations. Cloud-based solutions facilitate this flexibility but also require stringent cybersecurity controls to prevent unauthorized access. The rise in remote access has led to a surge in the adoption of identity and access management (IAM) systems, secure access service edge (SASE) architectures, and cloud firewalls tailored to the unique requirements of industrial networks. These security solutions ensure that even as organizations become more decentralized, their operational integrity and data privacy are not compromised.

The on-premise segment is projected to grow at a significant CAGR from 2025 to 2033. The customization advantage of on-premise cybersecurity systems is fueling their adoption. Every industrial site has its combination of machinery, network configurations, legacy systems, and safety protocols. While cloud-based platforms tend to offer standardized security solutions that work across environments, on-premise systems can be finely tuned to accommodate the unique demands of a specific plant or production line. This means that protective mechanisms such as firewall rules, behavioral analytics, or endpoint monitoring tools can be designed with detailed knowledge of the actual operating environment. The ability to design, deploy, and control this level of tailored defense is more feasible in on-premise architectures than in generalized cloud-based models.

Enterprise Size Insights

The large enterprises segment dominated the industrial cyber security industry in 2024. The increasing digitization of operations through smart factories and autonomous systems further drives the growth of industrial cybersecurity in large enterprises. These organizations are adopting advanced technologies such as robotics, machine learning, and digital twins to enhance efficiency and agility. However, as these technologies depend on high volumes of real-time data and continuous connectivity, they become prime vectors for cyber threats. Any disruption, whether caused by ransomware, insider threats, or nation-state attacks, can bring operations to a standstill and affect multiple plants simultaneously. This potential for widespread disruption compels large enterprises to implement multilayered cybersecurity architectures that can anticipate, detect, and respond to threats before they escalate.

The small & medium enterprises (SMEs) segment is projected to be the fastest-growing segment from 2025 to 2033. The adoption of operational digitization platforms such as enterprise resource planning (ERP), manufacturing execution systems (MES), and cloud-based analytics is driving segment growth. These systems collect, process, and store vast volumes of sensitive production data, customer orders, and supplier information that, if exposed or manipulated, could severely impact business continuity and customer satisfaction. SMEs adopting such platforms are realizing that cybersecurity must be integrated from the outset of digital transformation projects, not retrofitted later.

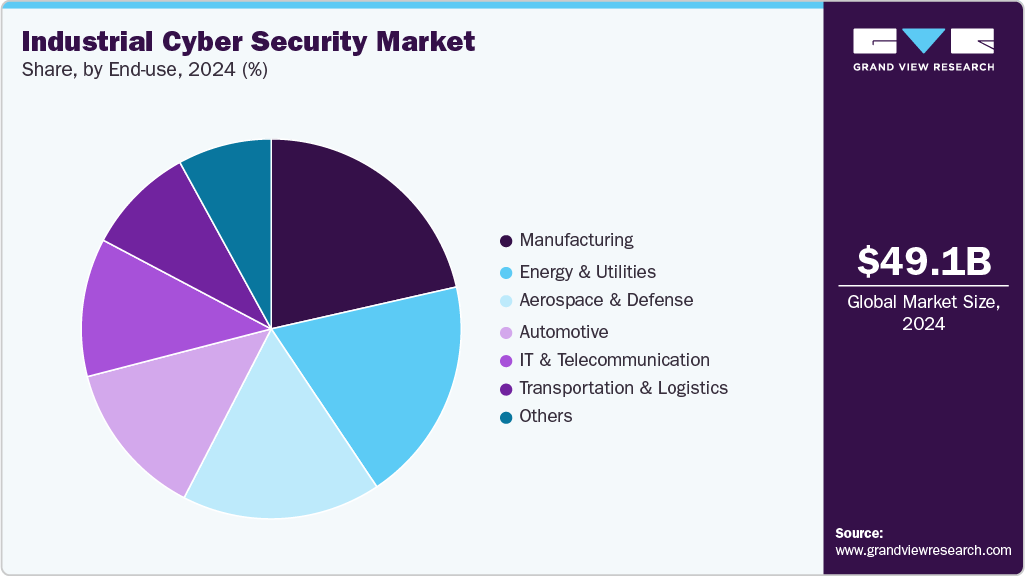

End Use Insights

The manufacturing segment dominated the market for industrial cyber security in 2024. The rise in targeted attacks on manufacturing infrastructure drives cybersecurity adoption in this segment. Manufacturing processes often depend on continuous operations and just-in-time supply chains. Even a short disruption can ripple through the business ecosystem, delaying deliveries, increasing waste, and violating service-level agreements. The manufacturing sector’s sensitivity to downtime has pushed companies to invest heavily in threat detection, incident response, and network segmentation tools that safeguard their production environments from both external and insider threats.

The IT & telecommunication segment is projected to be the fastest-growing segment from 2025 to 2033. The rapid deployment of 5G networks, which are enabling faster and more reliable machine-to-machine communication in industrial settings, is driving the segment growth. While 5G enhances operational efficiency, it also dramatically expands the attack surface by increasing the number of connected devices and entry points. Telecom providers are tasked with ensuring secure end-to-end data transmission across multiple nodes, some of which are in remote or unsecured industrial locations. This has prompted an industry-wide shift toward zero-trust architectures, network slicing security, and real-time threat detection systems that can prevent lateral movement of attacks across segmented industrial networks.

Regional Insights

North America dominated the industrial cyber security market with a revenue share of 36.5% in 2024. The rising frequency and impact of high-profile cyberattacks targeting industrial infrastructure are driving market growth. Incidents such as the Colonial Pipeline ransomware attack in the U.S. and cyber intrusions on power grids and water treatment facilities have served as wake-up calls to both public and private stakeholders. These attacks revealed the vulnerabilities of legacy industrial control systems when exposed to modern cyber threats. The tangible consequences of operational disruptions, from fuel shortages to public health risks, have spurred immediate and substantial investments in defensive cybersecurity measures.

U.S. Industrial Cyber Security Market Trends

The U.S. industrial cyber security industry is projected to grow during the forecast period. The U.S. workforce and operational environment play a role in shaping cybersecurity priorities. With many industrial operators managing large, geographically dispersed facilities, from chemical plants and oil refineries to transportation hubs, there is a growing need for secure remote access, mobile device management, and endpoint security. The pandemic accelerated the shift to remote operations, further exposing vulnerabilities in VPNs, remote desktops, and cloud-based industrial systems. Companies have responded by investing in zero-trust architectures, multi-factor authentication, and continuous monitoring systems that ensure secure access without compromising productivity.

Asia Pacific Industrial Cyber Security Market Trends

The Asia Pacific industrial cyber security industry is expected to be the fastest-growing segment, with a CAGR of 10.9% over the forecast period. The rapid expansion of manufacturing and industrial automation in the Asia Pacific is driving market growth. As the region cements its position as the global manufacturing hub, particularly for electronics, automotive, pharmaceuticals, and heavy machinery, there is an urgent need to secure supply chains, production lines, and logistics networks. The use of robotics, cloud-connected sensors, and predictive analytics in factories enhances efficiency but also introduces multiple entry points for cyber threats. To mitigate these risks, industrial firms are investing in security frameworks that offer real-time monitoring, anomaly detection, secure firmware updates, and endpoint protection across all industrial assets.

The industrial cyber security market in China is projected to grow during the forecast period, with numerous local firms emerging as providers of industrial-focused cyber defense solutions. These companies, often supported by government funding or state-owned enterprise partnerships, are helping close the technology gap and reduce reliance on foreign vendors. The development of indigenous solutions tailored to Chinese industrial standards and language preferences is contributing to the wider adoption of cyber security measures, especially among small and medium-sized enterprises (SMEs) in manufacturing hubs across the country. As these vendors expand their capabilities in areas such as intrusion prevention, network forensics, and ICS security assessment, the overall maturity of the industrial cyber security ecosystem in China continues to evolve.

Europe Industrial Cyber Security Market Trends

The industrial cyber security industry in Europe is expected to grow during the forecast period. Digital transformation across Europe’s industrial base is also fueling demand for cyber security. Initiatives like Germany’s Industry 4.0 and France’s France 2030 emphasize automation, smart systems, and cloud connectivity in manufacturing and logistics. While these initiatives aim to boost productivity and innovation, they also significantly expand the attack surface of industrial operations. Legacy systems are being connected to IT networks and cloud platforms, making them more vulnerable to cyberattacks. This digital convergence creates a strong incentive for companies to adopt industrial cyber security solutions that can bridge the gap between IT and OT environments while ensuring the availability, integrity, and confidentiality of industrial processes.

The industrial cyber security market in the UK is expected to grow during the forecast period. The presence of a highly developed cyber security ecosystem in the UK, centered around London and cyber clusters in regions like Cheltenham and Manchester, significantly supports market growth. The availability of domestic expertise, innovation from startups, and collaboration with academic institutions provides British industrial operators with access to cutting-edge technologies and services. Government-backed programs like the Cyber Security Academic Startups Accelerator Programme (CyberASAP) and partnerships with the NCSC encourage the development of advanced industrial cyber tools. This ecosystem makes it easier for industrial firms to adopt customized, scalable, and locally supported cyber security solutions that align with national security standards and industrial needs.

Key Industrial Cyber Security Company Insights

Some of the key companies operating in the market include Siemens and Palo Alto Networks.

-

Siemens is a global industrial conglomerate. Siemens’ industrial cybersecurity portfolio is its Industrial Security Services, which encompasses risk assessment, intrusion detection, secure network architecture, and incident response. These services are tightly integrated with Siemens’ automation and digitalization platforms, such as SIMATIC and TIA (Totally Integrated Automation), allowing for native security features in industrial control systems. Siemens also provides advanced firewalls, encrypted communications, user authentication protocols, and secure remote access solutions, all of which are essential for protecting the integrity and availability of critical industrial processes.

-

Palo Alto Networks is a global cybersecurity company. Palo Alto Networks’ Industrial OT Security solution, built on its broader Strata, Prisma, and Cortex platforms, ensures layered protection by combining firewall protection, Zero Trust principles, AI-powered threat detection, and seamless integration with Security Operations Centers (SOCs). The NGFW (Next-Generation Firewall) series and PAN-OS software provide the foundational layer for traffic segmentation and access control between IT and OT networks.

Tufin and DARKTRACE are some of the emerging participants in the industrial cyber security market.

-

Tufin is a provider of network security policy management solutions. Tufin’s SecureTrack and SecureChange products enable industrial organizations to monitor network changes in real-time, assess the risk associated with access requests, and automate compliance reporting. These tools support security frameworks and regulatory requirements relevant to industrial sectors, such as NERC CIP, IEC 62443, and ISO 27001. By integrating with firewalls and other network devices commonly found in OT environments, Tufin allows organizations to ensure that their network access rules are both secure and compliant without impeding critical operations.

-

Darktrace is a UK-based cybersecurity company specializing in the use of artificial intelligence and machine learning to protect digital environments across enterprises. Darktrace’s industrial cybersecurity offering includes Darktrace/OT solutions. This platform provides complete visibility into OT assets, communication patterns, and network behavior, even in air-gapped or legacy environments where standard security tools struggle to operate.

Key Industrial Cyber Security Companies:

The following are the leading companies in the industrial cyber security market. These companies collectively hold the largest market share and dictate industry trends.

- Arctic Wolf Networks Inc.

- Cisco Systems, Inc.

- Claroty

- CrowdStrike

- DARKTRACE

- Dragos

- Fortinet, Inc.

- Fortra, LLC

- Huntress

- Industrial Defender

- Palo Alto Networks

- Rapid7

- Red Canary

- Siemens

- Tufin

Recent Developments

-

In November 2024, Siemens and Digital Technologies Group (DTG) signed a Memorandum of Understanding (MoU) aimed at strengthening manufacturers’ capabilities in measuring and managing cybersecurity risks within their operations. Under this new partnership, DTG’s Cyber Assessment Tool (CAST), a comprehensive industrial cyber risk management solution, will be made available through Siemens’ open digital business platform, Xcelerator. The collaboration will also focus on deploying the CAST solution to their shared customer base.

-

In October 2024, Siemens collaborated with ServiceNow aimed at strengthening industrial cybersecurity and advancing the use of generative AI in shopfloor operations. This partnership combines Siemens’ Sinec Security Guard, which manages industrial vulnerabilities, and the Siemens Industrial Copilot, which brings generative AI-driven automation to the forefront. ServiceNow complements these capabilities by delivering workflow automation solutions that help streamline and optimize factory operations.

Industrial Cyber Security Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 52.93 billion |

|

Revenue forecast in 2033 |

USD 112.66 billion |

|

Growth rate |

CAGR of 9.9% from 2025 to 2033 |

|

Actual data |

2021 – 2024 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, solution type, security type, deployment, enterprise size, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Arctic Wolf Networks Inc.; Cisco Systems, Inc.; Claroty; CrowdStrike; DARKTRACE; Dragos; Fortinet, Inc.; Fortra, LLC; Huntress; Industrial Defender; Palo Alto Networks; Rapid7; Red Canary; Siemens; Tufin |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Industrial Cyber Security Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the industrial cyber security market report based on component, solution type, security type, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 – 2033)

-

Hardware

-

Software

-

Services

-

-

Solution Type Outlook (Revenue, USD Billion, 2021 – 2033)

-

SCADA

-

Intrusion Detection System/Intrusion Prevention System (IDS/IPS)

-

Identity and Access Management (IAM)

-

Security Information and Event Management (SIEM)

-

Unified Threat Management (UTM)

-

Data Loss Prevention (DLP)

-

DDoS

-

Others

-

-

Security Type Outlook (Revenue, USD Billion, 2021 – 2033)

-

Deployment Outlook (Revenue, USD Billion, 2021 – 2033)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 – 2033)

-

End Use Outlook (Revenue, USD Billion, 2021 – 2033)

-

Regional Outlook (Revenue, USD Billion, 2021 – 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global industrial cyber security market size was estimated at USD 49.13 billion in 2024 and is expected to reach USD 52.93 billion in 2025.

b. The global industrial cyber security market is expected to grow at a compound annual growth rate of 9.9% from 2025 to 2033 to reach USD 112.66 billion by 2033.

b. The hardware segment dominated the industrial cyber security market with a market share of 54.9% in 2024. The rising integration of edge computing and localized data processing in industrial setups is further boosting the demand for hardware-based security.

b. Some key players operating in the market include Siemens, Palo Alto Networks, Cisco Systems, Inc., Fortinet, Inc., CrowdStrike, Huntress, DARKTRACE, Rapid7, Arctic Wolf Networks Inc., Fortra, LLC, Red Canary, Industrial Defender, Claroty, Tufin, Dragos.

b. Factors such the growing convergence of operational technology (OT) and information technology (IT) systems across critical infrastructure and manufacturing environments and the increasing frequency and sophistication of cyberattacks targeting industrial operations is driving the industrial cyber security market.