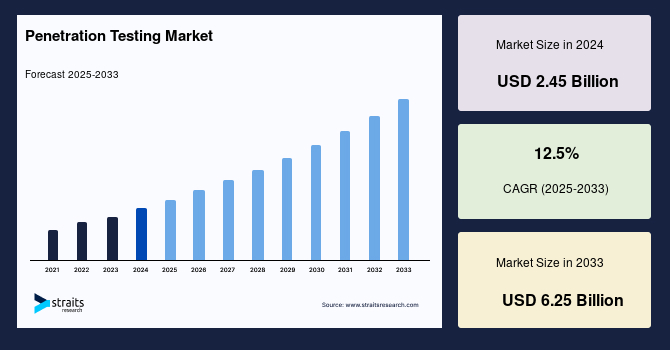

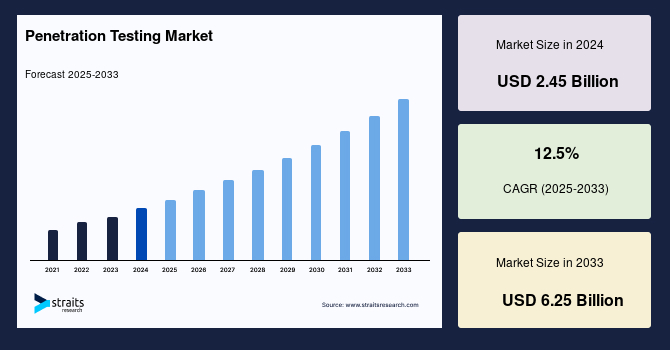

Penetration Testing Market Size

The global penetration testing market size was valued at USD 2.45 billion in 2024 and is projected to grow from USD 2.74 billion in 2025 to USD 6.25 billion by 2033, exhibiting a CAGR of 12.5% during the forecast period (2025–2033).

The global penetration testing market is driven by escalating cybersecurity threats and stringent regulations like GDPR, HIPAA, and PCI DSS mandating robust security assessments. The increasing adoption of cloud computing, IoT devices, and digital transformation across BFSI, healthcare, and IT sectors fuels demand for penetration testing to identify vulnerabilities. Key trends include the integration of AI and machine learning for automated testing, the rise of Penetration Testing as a Service (PTaaS), and cloud-based testing solutions enhancing scalability. North America dominates due to its advanced cybersecurity infrastructure, while Asia-Pacific is the fastest-growing region, driven by rapid digitisation in China and India. However, high costs and a shortage of skilled professionals pose challenges. The market’s growth reflects the critical need for proactive cybersecurity measures to protect digital assets in an increasingly interconnected, threat-prone environment, ensuring industry compliance and resilience.

Latest Market Trend

Rise of AI and machine learning in penetration testing

The integration of artificial intelligence (AI) and machine learning (ML) into penetration testing is a transformative trend, enhancing efficiency and accuracy in identifying vulnerabilities. In 2024, 80% of organisations cited regulatory compliance as a key driver for adopting advanced testing tools, with AI-powered solutions reducing testing time by up to 30%. The market is projected to grow with AI-driven automation streamlining repetitive tasks and analysing complex attack vectors.

- For example, in July 2024, FireCompass launched its Generative-AI-powered Agent AI, the first tool capable of autonomously executing full penetration testing, performing reconnaissance, attack planning, exploitation, and report generation.

This trend is particularly strong in North America, holding 35% of the market share in 2024, where cloud-based AI solutions are widely adopted. Asia-Pacific’s rapid digitisation further fuels demand, with 40% of enterprises planning AI-driven testing. As cyber threats evolve, AI and ML integration ensure faster, more precise testing, driving market growth across BFSI, healthcare, and IT sectors.

Penetration Testing Market Growth Factor

Escalating cybersecurity threats and regulatory compliance

The surge in cybersecurity threats and stringent regulatory requirements is a primary driver of the global market. With data breaches costing an average of USD 4.45 million in 2023 and 2.6 billion incidents reported in 2024, organisations prioritise proactive testing to mitigate risks. Regulations like GDPR, HIPAA, and PCI DSS, with non-compliance fines up to 4% of annual revenue, mandate regular security assessments.

- For instance, in February 2024, the National Cyber Security Agency in Qatar launched a Penetration Testing Accreditation program to enhance cyber service security, reflecting global regulatory trends.

North America leads due to robust compliance frameworks, while Asia-Pacific grows rapidly due to increasing cyber fraud. The growing complexity of IT environments, including cloud and IoT, further necessitates advanced testing, ensuring sustained market growth as organisations safeguard digital assets against evolving threats.

Market Restraint

High costs and a shortage of skilled professionals

High costs and a shortage of skilled professionals significantly restrain the global market. Penetration testing services, particularly for complex systems, can cost SMEs upwards of USD 50,000 per test, limiting adoption, with 50% of small businesses failing within six months of a data breach due to inadequate testing frequency. The market faces a skills gap, with organisations citing a lack of expertise as a barrier. This challenge is exacerbated by the need for specialised knowledge in AI and cloud-based testing, with only 15% of cybersecurity professionals trained in advanced penetration testing techniques.

Additionally, the U.S. tariffs on imported hardware accelerators, like cryptographic modules, are expected to increase costs further, impacting affordability. Asia-Pacific, despite rapid growth, struggles with a limited talent pool and a slowing implementation. For example, healthcare organisations reported difficulties hiring skilled testers for HIPAA-compliant testing. These constraints, particularly in cost-sensitive markets, hinder expansion, necessitating cost-effective, automated solutions to bridge the gap.

Market Opportunity

Growth in cloud-based testing and PTaaS

The rise of cloud-based penetration testing and Penetration Testing as a Service (PTaaS) presents a significant opportunity for the global penetration testing market. Cloud-based testing, expected to grow at a higher CAGR than on-premises, offers scalability and cost-effectiveness, with 80% of organisations adopting cloud solutions. PTaaS provides continuous, automated testing that is appealing to SMEs.

- For example, in March 2024, F5 integrated automated penetration testing into its Distributed Cloud Services post-Heyhack acquisition, enhancing vulnerability detection for multi-cloud environments.

- Similarly, BreachLock’s February 2024 expansion of AI-powered PTaaS solutions improved attack surface management for enterprises, offering scalable security assessments.

North America, with a 35% market share, and Asia-Pacific, driven by India’s Digital India initiative, are key growth regions. The increasing adoption of cloud computing and regulatory pressures create demand for accessible, efficient testing solutions, positioning cloud-based PTaaS as a transformative opportunity for market expansion.

Regional Insights

North America remained the dominant region, holding a 39% share of the global penetration testing market. The region’s leadership stems from its advanced cybersecurity infrastructure, home to leading players such as IBM, Rapid7, Cobalt, and CrowdStrike. High-profile cyberattacks and regulatory frameworks like HIPAA, PCI DSS, and the U.S. National Cybersecurity Strategy continue to drive market growth. BFSI and healthcare organisations in the U.S. face increasing attack volumes, prompting widespread adoption of advanced AI-powered testing platforms. Strategic partnerships, like Cobalt’s collaboration with NTT DATA, exemplify regional efforts to expand testing capabilities. Furthermore, strong technological innovation, mature DevSecOps practices, and high awareness levels ensure that North America remains at the forefront of penetration testing adoption, addressing the rising complexity of multi-cloud and hybrid IT environments.

U.S. Penetration Testing Market Trends

- The US leads the market, holding a 38% share in 2024, driven by an advanced cybersecurity ecosystem, regulatory mandates (HIPAA, PCI DSS), and high cyberattack volume. The updated U.S. National Cybersecurity Strategy allocated USD 2.5 billion for R&D in 2024, enhancing penetration testing capabilities across BFSI, healthcare, and government sectors. Silicon Valley tech hubs foster innovation, with companies like CrowdStrike developing AI-powered penetration testing platforms that address emerging threats such as AI-driven attacks and supply chain vulnerabilities. Widespread adoption of cloud and multi-cloud environments further drives testing demand, ensuring the U.S. maintains its global leadership position.

- Canada’s penetration testing market is growing at a CAGR of 12% through 2030, fueled by increasing cyberattacks, expanding digital services, and regulatory compliance demands. BFSI and healthcare organisations prioritise penetration testing, with 80% of businesses emphasising compliance requirements. Tech hubs in Toronto and Vancouver attract global firms like FireCompass, which promote AI-driven cloud testing solutions. The rise in remote work, increased use of IoT devices, and cross-border data flows further amplify the need for advanced penetration testing services, positioning Canada as a key player in North America.

Asia-Pacific Penetration Testing Market Trends

Asia-Pacific is the fastest-growing market, driven by rapid digital transformation, increasing cyber threats, and government investments. In 2024, the region accounted for 30% of global cyberattacks, highlighting vulnerabilities across BFSI, IT, healthcare, and e-commerce sectors. India and China are leading growth markets, supported by major government initiatives like India’s Digital India program and China’s Made in China. BFSI institutions in India, handling 40% of global digital transactions, prioritise penetration testing to combat fraud. The region’s expanding SME sector and evolving data protection regulations propel demand for scalable, cloud-based, and AI-driven penetration testing solutions. Asia-Pacific’s growing tech hubs are a major force in global market expansion.

- China’s penetration testing market is growing at a CAGR of 18.7%. This rapid expansion is fueled by accelerated digital transformation, strict Cybersecurity Law enforcement, and substantial government investment. With over 1 billion internet users and 30% of global cyberattacks in 2024, sectors like BFSI, healthcare, and retail actively adopt penetration testing solutions. Major tech hubs in Beijing and Shanghai drive AI-powered and cloud-based testing innovation, while government-backed initiatives ensure robust market development.

- India is the fastest-growing penetration testing industry with a CAGR of 19%. The Digital India initiative invested USD 1 billion in cybersecurity in 2024, fueling market growth. BFSI institutions, handling 40% of global digital transactions, prioritise penetration testing to counter cyber fraud. With 900 million internet users and 25% of Asia-Pacific’s cyberattacks in 2024, demand for scalable solutions is surging. Tech hubs in Bangalore and Hyderabad attract multinational firms like IBM and Cisco, advancing cloud, IoT, and AI-powered penetration testing capabilities. India’s regulatory developments further strengthen its role as a cybersecurity hub.

Europe Penetration Testing Market Trends

Europe holds a 25% share of the global market in 2024, driven by stringent data privacy regulations like GDPR and rising cyber threats across industries. Countries such as Germany, the UK, and France lead regional growth. Germany’s Industry 4.0 initiative invested USD 800 million in 2024 to bolster the manufacturing, BFSI, and government sectors’ cybersecurity. The UK’s National Cyber Security Centre invested USD 500 million to strengthen national cybersecurity resilience. Europe’s mature legal frameworks, skilled cybersecurity workforce, and emphasis on AI and cloud integration fuel steady market growth. Increasing digitalisation among SMEs further amplifies the demand for advanced penetration testing to ensure compliance and secure business continuity.

- The UK commands a significant share of Europe’s penetration testing market, with a projected CAGR of 10%. GDPR compliance, heightened privacy concerns, and increasing DDoS attacks (26% of EMEA incidents in 2023) drive market growth. The UK’s National Cyber Security Centre allocated USD 500 million to enhance cybersecurity resilience, promoting widespread adoption of penetration testing across BFSI, healthcare, and critical infrastructure sectors. Around 50% of UK firms implemented penetration testing solutions in 2024. London’s thriving tech ecosystem and leadership in DevSecOps practices further fuel demand for automated and AI-driven penetration testing platforms.

- Germany’s market for penetration testing is expanding, underpinned by GDPR regulations and Industry 4.0 initiatives. With 40% of enterprises planning to adopt penetration testing by 2025, Germany’s growing digital economy drives demand for IoT, cloud, and AI-powered testing solutions. The country’s major innovation hubs, Munich and Frankfurt, host leading companies focusing on advanced cybersecurity. Partnerships, such as Rapid7’s collaboration with local cloud providers, enhance Germany’s testing infrastructure, positioning it as a European cybersecurity leader.

Need a Custom Report?

We can customize every report – free of charge – including purchasing stand-alone sections or country-level reports

Offering Insights

The solutions segment, encompassing penetration testing software, tools, and automated platforms, dominated the market with over 65% revenue share in 2024. This dominance is driven by the increasing sophistication of cyber threats, with 2.6 billion data breaches reported in 2024, necessitating advanced tools to detect vulnerabilities. AI-powered solutions, reducing testing time by 30%, are gaining traction. The segment is projected to grow, fueled by the rise in cloud-based testing and regulatory compliance needs like PCI DSS and GDPR. North America’s robust cybersecurity ecosystem and Asia-Pacific’s digital transformation drive demand for scalable, automated solutions. This ensures the segment’s leadership in addressing evolving attack vectors across BFSI, healthcare, and IT sectors.

Deployment Mode Insights

The on-premises segment held a significant market share in 2024, driven by its appeal to large enterprises requiring high security and control, particularly in BFSI and government sectors. With 80% of organisations prioritising regulatory compliance in 2024, on-premises solutions ensure data sovereignty and compliance with HIPAA and GDPR. The segment is projected to grow due to its ability to handle sensitive data in regulated environments. The segment’s growth is supported by the need for customised testing in complex IT systems, especially in North America, where 39% of the global market resides. Despite cloud-based growth, on-premises testing remains dominant for industries prioritising security over scalability.

Vertical Insights

The BFSI segment led the market with a significant share in 2024, driven by the high volume of sensitive financial data and stringent regulations like PCI DSS and GLBA. With data breaches costing USD 4.45 million on average in 2023, BFSI organisations prioritise penetration testing to protect transactions and customer data. The segment is expected to grow, fueled by the rise in cloud-based UPI transactions and cyber threats. North America’s financial hubs and Asia-Pacific’s digital banking boom, with 40% of global transactions in 2024, drive demand. The segment’s dominance is reinforced by the need for continuous testing to counter sophisticated attacks, ensuring trust and regulatory adherence.

Market Size By Offering

Solutions

Services

Company Market Share

Key players in the global penetration testing market emphasise innovation, AI integration, and strategic partnerships to maintain competitiveness. Companies invest in R&D to develop automated, cloud-based testing tools, addressing complex vulnerabilities. Mergers, acquisitions, and collaborations with cloud providers expand market reach, particularly in BFSI and healthcare.

Rapid7, Inc.: Rapid7 holds a significant share in the penetration testing market, leveraging its cloud-native platforms and AI-driven solutions. Its business pattern focuses on continuous testing, DevSecOps integration, and strategic partnerships with MSSPs to expand reach. Rapid7’s subscription-based PTaaS model targets SMEs and enterprises, ensuring compliance with PCI DSS and GDPR.

Latest News

- In April 2025, Rapid7 enhanced its cloud-native penetration testing platform, introducing AI-powered vulnerability prioritisation for BFSI clients. This upgrade ensures compliance with PCI DSS, addressing the 2.6 billion data breaches reported in 2024, and strengthens Rapid7’s position in the U.S. and European markets.

List of key players in Penetration Testing Market

- Rapid7, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- CrowdStrike, Inc.

- FireCompass

- Synack, Inc.

- Checkmarx

- Veracode

- Fortinet, Inc.

- Coalfire Systems, Inc.

- Trustwave Holdings, Inc.

- HackerOne

- Bugcrowd

- Secureworks, Inc.

- Netsparker

Recent Developments

- March 2025– F5 acquired LeakSignal, a specialist in real-time data protection for AI applications. The move enhances F5’s Application Delivery & Security Platform with AI-driven data classification and compliance features.

- March 2025– FireCompass released updates to its PTaaS platform, adding features like a new CISO dashboard, ~800 vulnerability detections, and 50+ attack trees.

- September 2024– Oracle introduced a Penetration Testing service for Oracle Cloud Infrastructure (OCI) across AWS, Azure, Google, OCI region, and supercluster environments, reflecting growth in AI and cloud pentesting needs.

Penetration Testing Market Segmentations

By Offering (2021-2033)

- Solutions

- Services

By Deployment Mode (2021-2033)

- Cloud-Based

- On-Premises

By Vertical (2021-2033)

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- IT & IT-enabled Services (ITES)

- Telecommunications

- Retail & E-commerce

- Government & Defense

- Manufacturing

- Education

- Others

By Region (2021-2033)

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

The global penetration testing market was valued at USD 2.74 billion in 2025 and is projected to reach USD 6.25 billion by 2033.

Top industry players are Rapid7, Inc.,IBM Corporation,Cisco Systems, Inc.,CrowdStrike, Inc.,FireCompass,Synack, Inc.,Checkmarx,Veracode,Fortinet, Inc.,Coalfire Systems,Inc.,