Space Cybersecurity Market Summary

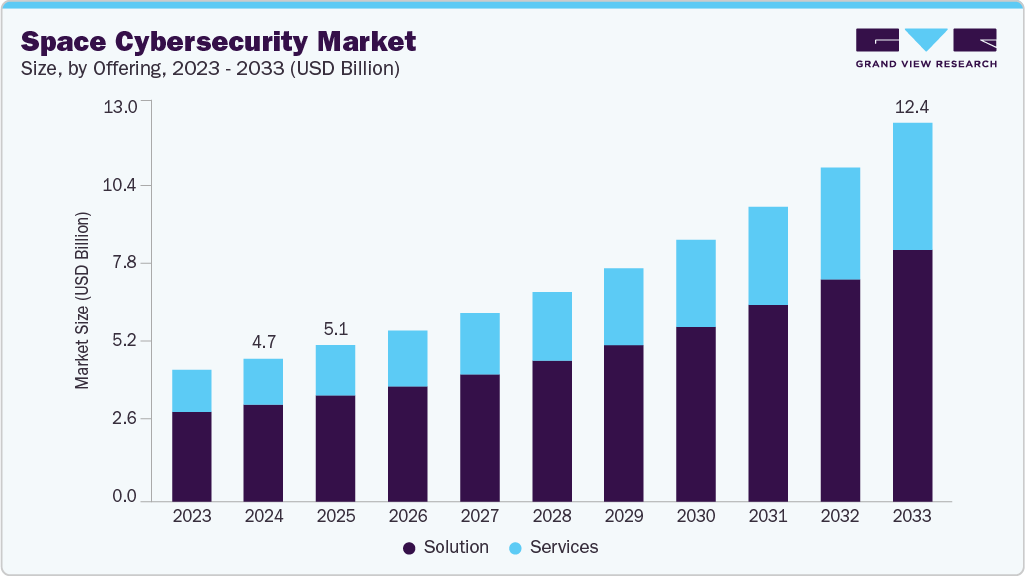

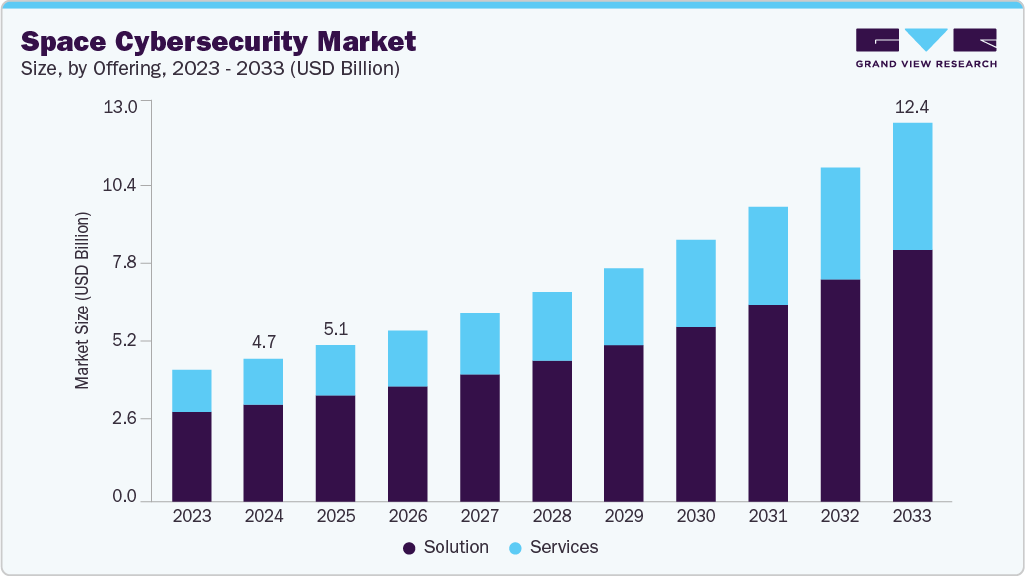

The global space cybersecurity market size was estimated at USD 4.68 billion in 2024 and is projected to reach USD 12.37 billion by 2033, growing at a CAGR of 11.7% from 2025 to 2033, owing to the rapid digital transformation of the space industry.

Key Market Trends & Insights

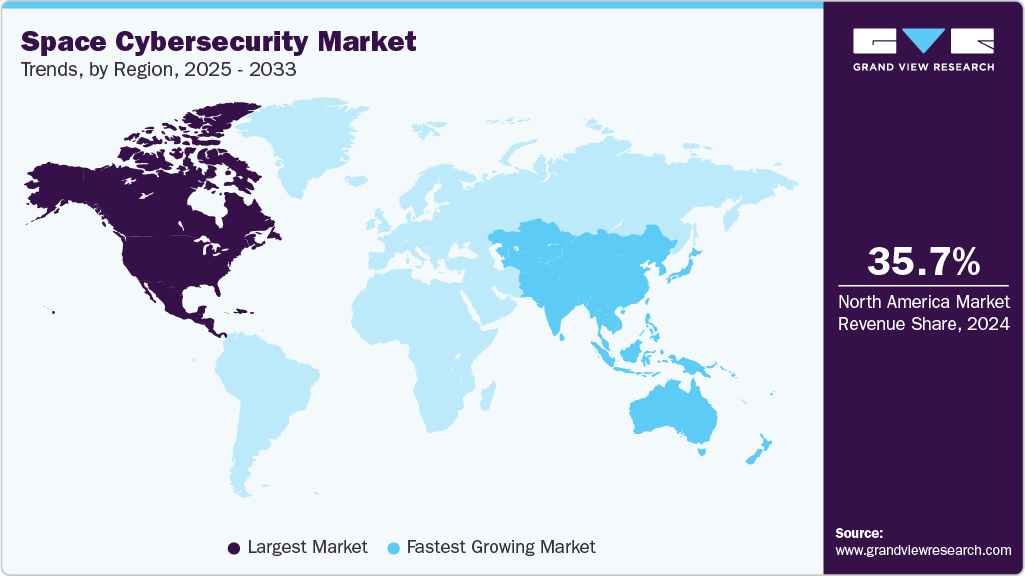

- North America held a 35.7% revenue share of the global space cybersecurity market in 2024.

- In the U.S., the market is driven by the growing focus on strengthening the cyber resilience of space assets across all segments.

- By offering, the solution segment held the largest revenue share of 68.1% in 2024.

- By platform, the satellites segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.68 Billion

- 2033 Projected Market Size: USD 12.37 Billion

- CAGR (2025-2033): 11.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As satellite constellations, space assets, and ground-based control systems become more interconnected and data-intensive, cybersecurity has emerged as a mission-critical priority. Government agencies, defense contractors, and private aerospace firms are investing heavily in advanced cybersecurity frameworks to safeguard critical space infrastructure from evolving cyber threats, including nation-state attacks, ransomware, and signal jamming.

The increasing deployment of small satellites (smallsats), low Earth orbit (LEO) networks, and autonomous spacecraft has led to greater surface area for potential cyber intrusions. In parallel, the adoption of cloud-based ground segment operations and AI-driven space mission planning requires robust, scalable cybersecurity solutions capable of protecting data flows between space and terrestrial systems.

Furthermore, as the space domain becomes more commercialized and integrated with national security architectures, the need for resilient, AI-enhanced cybersecurity tools grows in importance. Emerging trends such as satellite-to-satellite communications, space-based edge computing, and space situational awareness (SSA) platforms underscore the demand for adaptive cybersecurity systems that can secure both orbital and ground-based infrastructure in real time.

Satellites depend heavily on networked communications for command and control, telemetry, and data transmission to and from Earth. These communication links are increasingly targeted by cyber threats such as jamming, spoofing, interception, and unauthorized access. As a result, network security solutions ranging from firewalls and intrusion detection systems to encryption and secure communication protocols are essential to ensure the confidentiality and availability of data across space systems. In conclusion, network security remains the cornerstone of space cybersecurity solutions because it protects the essential infrastructure, enabling all space-based communication and operations.

Offering Insights

The solution segment led the market with the largest revenue share of 68.1% in 2024, driven by the increasing complexity and scale of cyber threats targeting space assets. The proliferation of satellite constellations and interconnected space systems has expanded the attack surface, making space infrastructure more susceptible to cyberattacks. Advanced cybersecurity solutions are essential to protect against these evolving threats, thus contributing significantly to driving the market expansion. For instance, in June 2023, SpiderOak developed OrbitSecure, a cybersecurity platform designed to protect satellite communications and data. The company has partnered with industry leaders such as Lockheed Martin and Raytheon Technologies to enhance their cybersecurity solutions for space applications. Therefore, the growing adoption of solutions is contributing significantly to spurring the market share.

The service segment is expected to grow at the fastest CAGR during the forecast period. The escalating frequency of cyberattacks targeting space infrastructure, including satellites and ground stations, has heightened the demand for specialized cybersecurity services. These services are essential for safeguarding critical space-based assets from evolving threats. In addition, the swift expansion of both military and commercial space operations necessitates robust cybersecurity measures. As nations and private entities deploy more satellites and space systems, the need for comprehensive security services to protect these assets becomes paramount. Moreover, the adoption of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Zero Trust Architecture (ZTA) in cybersecurity services enhances the ability to detect and respond to threats in real-time, further contributing to market expansion.

The professional services segment accounted for the largest market revenue share in 2024. Space systems are intricate and require specialized expertise for their design, implementation, and maintenance. Professional services, including consulting, integration, and training, offer the necessary support to ensure these systems are secure and resilient against cyber threats. In addition, the cyber threat landscape is continuously evolving, necessitating adaptive and proactive security measures. Professional services provide organizations with the expertise to assess risks, implement security frameworks, and respond to emerging threats effectively.

Platform Insights

The satellite segment accounted for the largest market revenue share in 2024, due to the increasing reliance on satellite infrastructure for communication, navigation, Earth observation, and defense purposes. As the number of satellite constellations expands, so do the complexity and vulnerability of these systems, making them prime targets for cyberattacks. For instance, the 2022 Viasat cyberattack disrupted satellite communication services across Europe, highlighting the critical need for robust cybersecurity measures.

The spaceports & launch facilities segment is projected to register at the fastest CAGR during the forecast period. As space becomes increasingly commercialized, the number of launches is rising rapidly. New launch vehicles, private launch providers (SpaceX, Blue Origin, Rocket Lab), and international agencies are conducting more frequent missions. Each launch involves complex digital systems ranging from telemetry and propulsion control to flight path calculations that are vulnerable to cyber interference. This surge has made spaceports and launch sites prime targets for sabotage, espionage, and ransomware attacks, driving demand for advanced cybersecurity.

End Use Insights

The government & defense segment accounted for the largest market revenue share in 2024, owing to several critical factors tied to the strategic importance and sensitive nature of space assets used by these sectors. Government and defense agencies rely heavily on space-based systems for national security, surveillance, reconnaissance, communication, navigation, and missile defense. These space assets are critical to maintaining military advantages and safeguarding national interests. For instance, in January 2025, Thales Alenia Space and Hispasat launched Spain’s first Quantum Key Distribution (QKD) mission in geostationary orbit, backed by a USD 109 million budget. This project develops a quantum payload and secure ground systems to distribute encryption keys, to boost space communication security and is funded by Spain’s Recovery, Transformation, and Resilience Plan. Consequently, governments prioritize robust cybersecurity measures to protect satellites, ground stations, and communication links from sophisticated cyber threats.

The commercial segment is anticipated to register at the fastest CAGR during the forecast period. Private companies are increasingly launching satellites and developing space-based services like broadband internet (Starlink, OneWeb), Earth observation, and space tourism. This surge in commercial space operations expands the attack surface, driving demand for cybersecurity solutions. In addition, commercial satellites handle massive volumes of sensitive data, making them attractive targets for cyberattacks. Protecting this data requires advanced cybersecurity measures, thereby boosting commercial segment growth.

Regional Insights

North America dominated the space cybersecurity market with the largest revenue share of 35.7% in 2024. North America is at the forefront of space cybersecurity trends, driven by substantial investments from government agencies like NASA and the Department of Defense, as well as leading commercial space companies such as SpaceX and Blue Origin. The region faces persistent cyber threats targeting space systems, including jamming, spoofing of GPS signals, and increasingly sophisticated cyberattacks on satellites and ground control infrastructure. These threats are compounded by the rapid growth of satellite constellations, especially in low Earth orbit, which expands the attack surface and increases vulnerabilities.

U.S. Space Cybersecurity Market Trends

The space cybersecurity market in the U.S. is projected to grow at the fastest CAGR during the forecast period, characterized by a robust focus on strengthening the cyber resilience of space assets across all segments user, ground, link, and orbit through advanced technologies such as AI-driven threat detection, automated response, and real-time analysis to counter increasingly sophisticated cyberattacks. A key trend is the integration of commercial space industry capabilities with military space operations under initiatives like the Commercial Augmentation Space Reserve (CASR), aiming to enhance cybersecurity by leveraging cutting-edge commercial technologies while managing risks related to supply chain diversity and interoperability.

Europe Space Cybersecurity Market Trends

The space cybersecurity market in Europe is expected to grow at a significant CAGR of 10.8% from 2025 to 2033. The increasing recognition of the space sector as critical infrastructure subject to stringent cybersecurity regulations, such as the EU’s NIS2 Directive and the Cyber Resilience Act, imposes robust security requirements on satellite operators and associated ground systems. In addition, the European Union Agency for Cybersecurity (ENISA) highlights the growing threat landscape for commercial satellites, driven by factors including the widespread use of off-the-shelf and open-source components, software-defined satellites, in-orbit reconfigurations, onboard intelligence, and emerging quantum technologies, all of which increase vulnerability to cyberattacks.

The Germany space cybersecurity market accounted for the largest market revenue share in 2024. The ongoing trends are marked by significant advancements in operational resilience and strategic autonomy, anchored by the European Space Agency’s (ESA) newly inaugurated Cyber Security Operations Centre (C-SOC) at the European Space Operations Centre (ESOC) in Darmstadt, Germany. This dual-site C-SOC facility, operating across Germany and Belgium, is designed to monitor and protect ESA’s critical space assets-from satellites in orbit to ground stations and mission control systems-against increasingly sophisticated cyber threats. The center leverages advanced real-time monitoring, threat analysis, and rapid incident response capabilities, processing billions of security-relevant events monthly to safeguard Europe’s space infrastructure, which is vital to sectors like energy, finance, and supply chains.

Asia Pacific Space Cybersecurity Market Trends

The space cybersecurity market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Asia Pacific’s space cybersecurity trends reflect a rapidly evolving threat landscape marked by a surge in ransomware and malware attacks targeting critical infrastructure, including satellite and space-related systems. State-sponsored cyber espionage is intensifying, with attackers exploiting edge devices, IoT systems, and supply chain interdependencies to bypass traditional defenses, heightening risks for space assets amid geopolitical tensions in the region. To address these issues, Asia Pacific is increasingly leveraging AI and machine learning for advanced threat detection and response, investing in quantum-resistant security measures, and fostering public-private partnerships involving major technology firms like AWS, Cisco, and Qualcomm to enhance cyber resilience.

The China space cybersecurity market accounted for the largest market revenue share in 2024. The ongoing trends reveal a complex and evolving landscape marked by significant advancements in military space capabilities and dual-use satellite technologies. Beijing has reorganized its armed forces to create a dedicated space operations force, reflecting the strategic importance it places on space dominance. Chinese satellites in low Earth orbit (LEO) and geostationary Earth orbit (GEO) exhibit highly maneuverable capabilities, demonstrating operator proficiency and the development of sophisticated tactics and procedures that could be employed in space warfare, both defensively and offensively.

Key Space Cybersecurity Company Insights

Some of the key companies operating in the market are Lockheed Martin Corporation, Northrop Grumman, Thales, among others are some of the leading participants in the space cybersecurity industry.

-

Lockheed Martin is a leading provider of space cybersecurity solutions, using AI and machine learning to protect satellites and ground systems from advanced cyber threats. The company supports U.S. military space programs with secure, resilient satellite networks and real-time threat detection, leveraging innovative technologies like 5G connectivity and autonomous operations to ensure mission-critical space assets remain secure in a contested environment.

-

Northrop Grumman is a leading provider of space cybersecurity solutions, developing advanced hardware and software like the Space End Crypto Unit (ECU) to protect interconnected satellite networks from cyberattacks. Their technologies enable secure, high-speed communication and cryptographic processing for proliferated low Earth orbit (pLEO) constellations, supporting U.S. military initiatives such as the Joint All Domain Command and Control (JADC2).

Pan Galactic and InspeCity are some of the emerging market participants in the space cybersecurity industry.

-

Pan Galactic is a UK-based space tech startup developing GalacticOS, a quantum-safe operating system designed to secure space systems against current and future cyber threats, including those posed by quantum computing. GalacticOS integrates industry-leading post-quantum encryption standards and blockchain technology to ensure data integrity, resilience, and secure communications in space environments. The OS is lightweight, hardware-agnostic, and runs from system boot, providing continuous quantum-safe cybersecurity.

-

InspeCity is an Indian space technology startup focused on sustainable space operations by developing advanced tools for satellite life extension, in-orbit servicing, and environmental responsibility. Founded in 2022 and headquartered in Thane, Maharashtra, InspeCity creates innovative propulsion systems, robotic arms, and precision sensing technologies to enable satellite refueling, repair, and debris mitigation, reducing the need for costly replacements and minimizing space waste. The company has won prestigious defense innovation challenges and formed strategic partnerships with space-tech ecosystems in Japan and Taiwan.

Key Space Cybersecurity Companies:

The following are the leading companies in the global space cybersecurity market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- Northrop Grumman

- Thales

- Airbus

- Booz Allen Hamilton

- BAE Systems

- CHI Group

- Checkpoint Software Technologies

- SpiderOak Mission Systems

- Xage Security, Inc.

- Anduril Industries, Inc.

- Cisco

- CrowdStrike

- Fortinet

- Sophos

Recent Developments

-

In May 2025, The European Space Agency (ESA) inaugurated a new Cyber Security Operations Centre (C-SOC) at its European Space Operations Centre in Germany. This dedicated facility will monitor and protect ESA’s digital and space assets, including satellites and ground stations, addressing the growing sophistication of cyber threats in space.

-

In April 2025, Frontgrade Gaisler, a leading developer of radiation-hardened microprocessors for space missions, partnered with wolfSSL, a recognized expert in embedded security solutions, to meet the increasing demand for advanced cybersecurity in space applications. This collaboration will integrate Frontgrade Gaisler’s resilient hardware with wolfSSL’s robust security software libraries.

-

In October 2024, SpiderOak announced that it will open source its encryption-based software, enabling external developers to collaborate on the project and enhance its security features. The software, which is used by U.S. government agencies and organizations in the space and defense industries, is built on a zero-trust architecture-an approach that assumes no user or system is inherently trustworthy.

Space Cybersecurity Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.10 billion |

|

Revenue forecast in 2033 |

USD 12.37 billion |

|

Growth rate |

CAGR of 11.7% from 2025 to 2033 |

|

Base year for estimation |

2024 |

|

Historical data |

2021 – 2023 |

|

Forecast period |

2025 – 2033 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offering, platform, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled |

Lockheed Martin Corporation; Northrop Grumman; Thales; Airbus; Booz Allen Hamilton; BAE Systems; CHI Group; Checkpoint Software Technologies; SpiderOak Mission Systems; Xage Security, Inc.; Anduril Industries, Inc.; Cisco; CrowdStrike; Fortinet; Sophos |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Space Cybersecurity Market Report Segmentation

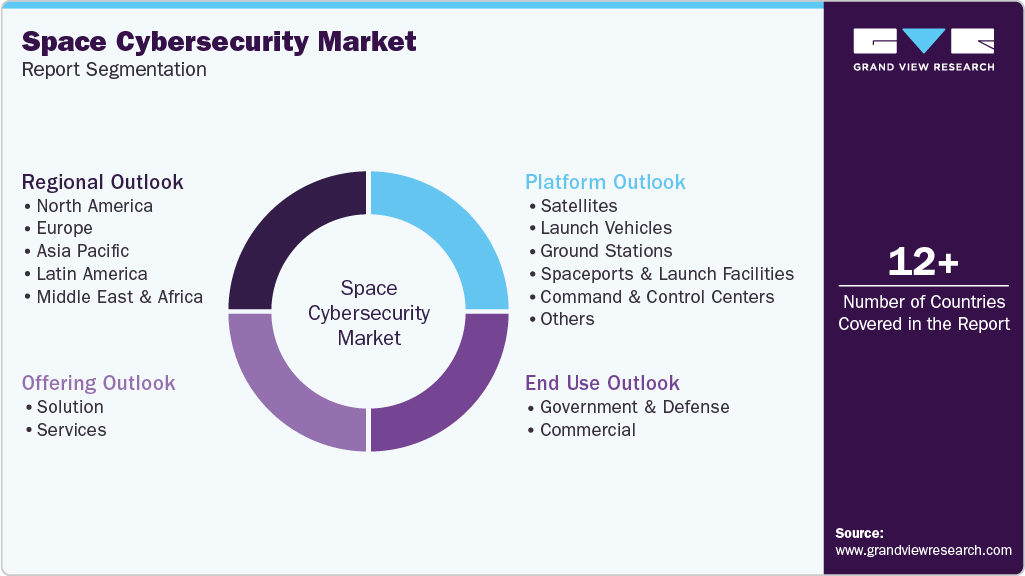

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global space cybersecurity market report based on offering, platform, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2021 – 2033)

-

Solution

-

Services

-

Professional Services

-

Managed Services

-

-

-

Platform Outlook (Revenue, USD Million, 2021 – 2033)

-

End Use Outlook (Revenue, USD Million, 2021 – 2033)

-

Government & Defense

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-